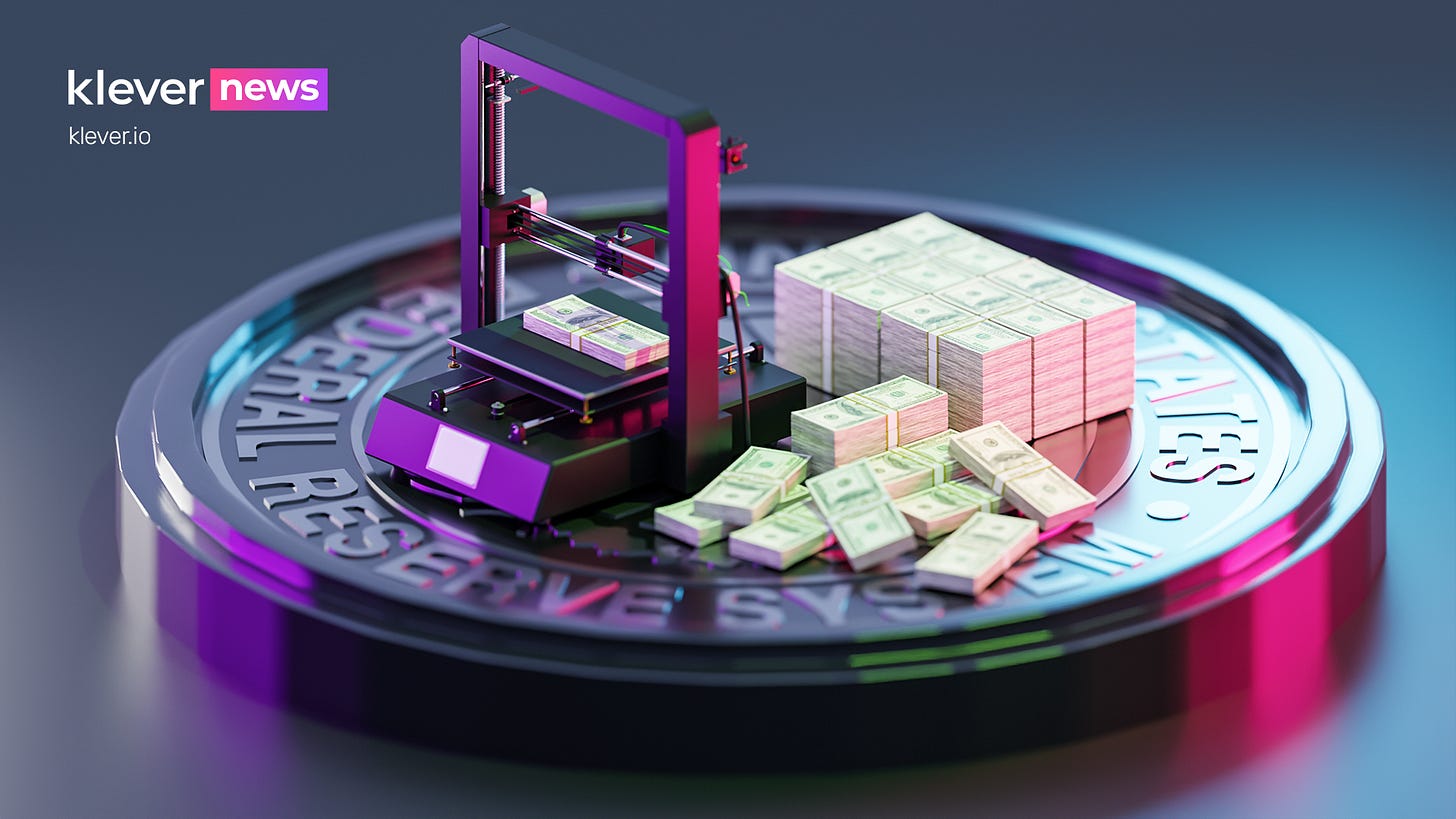

US Dollar money printing powering Bitcoin's rise

The plummeting of the dollar is reaching new lows as the US is printing money on a relentless & unprecedented level, while Bitcoin’s provable scarcity & deflationary model is fueling its rise globally

The Federal Reserve has been minting new USD at record speed over recent months, primarily to provide for stimulus packages enacted by the US government in response to the ongoing economic crisis caused by Covid-19.

The US dollar index reached its lowest point in over 2,5 years on December 3, dumping to 90.5 from a high of over 103 in March this year. To add injury to insult, the long-term inflation rate of the dollar has grown to 1,85%, undergoing a significant rise from the spring of this year when the same metric was as low as 0,5%.

Covid’s impact on the US economy

The US economy has taken a massive hit by the exacerbating and detrimental effects of coronavirus lockdowns, leading to rolling business closures nationwide, loss of employment for millions of Americans and the devaluing of people’s savings through the inflation of the dollar. The current US administration’s failure to curb Covid throughout the US will likely have long term repercussions on the state of the American economy for many months, or even years, to come.

That being said, the incoming Biden administration’s likely Treasury Secretary, Janet Yellen, is a former Fed Chairwoman. This fact alone underscores that the long time policy of the Federal Reserve to print new dollars will most probably be clearly reflected, if not mirrored, in the US government’s macroeconomic decision making.

The Fed’s money printers working overtime

With this in mind, as relief packages and stimulus bills seek approval through US Congressional halls, the mounting US debt will only deepen and The Fed’s balance sheet will expand further. Money printing on these unprecedented levels will however not cover the growing US budget deficit, but instead make the situation worse since the purchasing power of the USD is decreasing by the day.

Given that The Fed is meeting on December 15-16 to set its policy moving forward, we are likely to see more government assistance and stimulus packages being implemented, or at least attempted to become reality. Such relief packages and government measures will further rattle the global market’s views regarding the standing of the US dollar as the globe’s primary reserve currency.

Bitcoin truly solves this

We in the global Bitcoin and crypto community often, sarcastically may I add, use the expression “Bitcoin solves this” to any and all problems that rise to the surface, whether domestic financial predicaments or severe global economic issues. But strangely enough, the devaluation of the US dollar and its rising inflation as a result of money printing is a clear cut situation where the world is starting to face the reality: Bitcoin truly solves this problem.

As a sign of the changing times, the CEO of the world’s largest asset manager fund BlackRock, Larry Fink, expressed Bitcoin’s rise vs the dollar well when he recently stated that ”Bitcoin makes the US dollar less relevant.” Meanwhile, many institutional investors, publicly listed companies and hedge fund managers are touting The Fed’s relentless money printing as one of the main reasons for them to choose Bitcoin as a hedge against the inflation and apparent fall of the US dollar.

Bitcoin vs US dollar

While Bitcoin’s rise to surpass its All-Time High in price this week is an incredible accomplishment in and of itself by the world’s first and largest cryptocurrency, BTC is still minute in terms of its size when compared to the once-mighty US dollar. To compare the two is however not only important but essential as the tides are turning in Bitcoin’s favor on essentially every metric in the book.

The US dollar is estimated to have a circulating supply above 18.8 trillion USD, while Bitcoin currently stands at 359 billion USD in market cap. But looking at these numbers in its current state can be wildly deceiving. Firstly, Bitcoin is a provably and extremely scarce commodity, with only 21 million BTC to ever be minted and created. Secondly, since Bitcoin's market cap has multiplied 20 times over the past four years and more than 100 times over the past seven years, the growth of the Bitcoin network’s reach and its global impact can no longer be ignored.

Massive influx into Bitcoin

Additionally, The Fed is continuously resolving to print new dollars when facing a crisis, adding to the US’ mounting debt burden and its currency’s inflation. In stark contrast, Bitcoin will always be reducing the flow of new BTCs every four years through it’s “halving“ events. Furthermore, we are seeing a huge demand for Bitcoin in countries whose national fiat currencies are in deep financial crisis due to government mismanagement, such as Venezuela, Turkey, Iran, Argentina and more, a scenario not unlikely to face the US dollar in the coming years.

In conclusion, the US dollar and Bitcoin’s diametrically opposed approaches on how to deal with their newly minted supply and overall financial policy will serve as the foundation for Bitcoin to threaten the US dollar’s position over the coming years. With the former (USD) being inflationary and the latter (BTC) being deflationary in nature, it is becoming increasingly probable that we will likely soon witness a massive and unprecedented influx into Bitcoin worldwide as a hedge against the plummeting US dollar.

Misha Lederman

Director of Communications and Marketing at Klever.io

Download Klever App

Do you know of our new in-app Klever News feature?

You can read all of our articles inside the Klever App by simply clicking on the 🔔 icon in the lower left tab. Try it now!

ค่าเหรียญก็คงถุกไปด้

I say it everywhere since 3 years ! LoL